Leopardmoney

Leopardmoney is Bridge between you and Banks you will get all Best Credit Card in UAE Details under one umbrella.

These are the list of some iconic Credit Card offered in UAE.

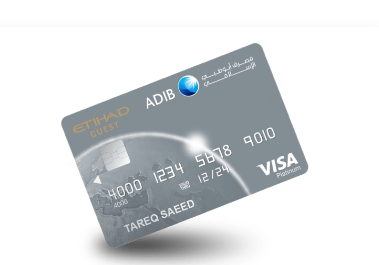

ADIB Etihad Guest Classic Card

- ADIB provide Top credit card in UAE if you are frequent traveler this right credit card for you these are the some feature of this card giving below:

- you can pay Etihad card annual fee by using Etihad Guest miles, but you will get 10k guest miles at the time of activation of this card you can also redeem Etihad guest miles and travel booking and you also get roadside assistance by calling at helpline number 600-542010

Documents Requirement:

Emirates ID, Visa Passport Copy, Salary Certificate 3 Month Bank Statement Fill the Form Above to get updated Schedule of Charges.

ADIB VISA CASH BACK PLATIMUM CREDIT CARD

key Benefits:

- Get 1% cash back on every purchase you done with ADIB Cash back Credit Card.

- Get Roadside Assistance ADIB cash back Credit Card also come up with same feature like ADIB ETIHAD CREDIT CARD. We offer free unlimited towing services within city limits, while intercity towing is limited to three times per year. Additionally, we provide jump start, flat tire, and lockout services free of charge. We also offer free fuel delivery once per year within the same city.

- Get Free access to lounges on airport which make this card worth to buy but you don’t need to wait like other passenger this card allow to access to lounges where you get food and drinks.

- With Draw 100 percent of your credit card limit and with grace period of 55 days.

ADIB Etihad Guest Platinum Card

The ADIB Etihad Guest Platinum Card is a Top credit card offered by Abu Dhabi Islamic Bank (ADIB) in partnership with Etihad Airways. It is designed to provide exclusive benefits and rewards for frequent flyers of Etihad Airways.

Here are some key features and benefits of the ADIB Etihad Guest Platinum Card:

- Etihad Guest Miles: The card allows you to earn Etihad Guest Miles on all your card spending. These miles can be redeemed for flight tickets, upgrades, hotel stays, car rentals, and other travel-related benefits.

- Welcome Bonus: As a new cardholder, you may be eligible for a welcome bonus of Etihad Guest Miles upon meeting certain spending criteria within a specified period.

- Lounge Access: The ADIB Etihad Guest Platinum Card provides complimentary airport lounge access to more than 1,000 lounges globally through the LoungeKey program. This allows you to relax and enjoy various facilities at participating lounges regardless of the airline or class of travel.

- Travel Insurance: Cardholders are entitled to travel insurance coverage, including benefits such as travel accident insurance, trip cancellation/interruption insurance, and baggage delay/loss insurance.

- Discounts and Offers: The card offers exclusive discounts and privileges on flight bookings, hotel reservations, car rentals, and other travel-related services. These discounts can help you save money and enhance your travel experience.

- Etihad Guest Tier Miles: In addition to earning Etihad Guest Miles, the card allows you to earn Tier Miles, which help you achieve or maintain a higher tier status within the Etihad Guest loyalty program. Higher-tier status offers additional benefits like priority check-in, extra baggage allowance, and lounge access.

- Flexible Payment Options: ADIB provides various payment options for cardholders, including installment plans and balance transfer facilities, allowing you to manage your finances effectively.

It’s important to note that specific terms and conditions, fees, and eligibility criteria may apply to the ADIB Etihad Guest Platinum Card. It’s recommended to visit the official ADIB website or contact the bank directly for the most up-to-date and accurate information regarding this credit card.

Earning Potential with ADIB Etihad Guest Platinum Card

The ADIB Etihad Guest Visa Gold Card is a co-branded credit card offered by the Abu Dhabi Islamic Bank (ADIB) in partnership with Etihad Airways. As a Visa Gold card, it provides various benefits and privileges to cardholders.

Here are some key features and benefits of the ADIB Etihad Guest Visa Gold Card:

- Etihad Guest Miles: The card is designed to help you earn Etihad Guest Miles on your everyday spending. Etihad Guest Miles are the frequent flyer miles of Etihad Airways, and you can accumulate these miles for free flights, upgrades, and other rewards.

- Sign-up Bonus: The card often offers a sign-up bonus in the form of Etihad Guest Miles, which you can earn by meeting the spending requirements within a specified period after card activation.

- Accelerated Earning: The card provides accelerated earning on specific categories such as flight bookings with Etihad Airways, retail purchases, dining, and more. This allows you to accumulate miles faster in these categories.

- Lounge Access: Cardholders may have access to airport lounges in select locations, providing a comfortable and relaxing environment before your flight.

- Travel Benefits: The ADIB Etihad Guest Visa Gold Card offers travel-related benefits such as travel insurance coverage, purchase protection, and extended warranty on certain purchases.

- Discounts and Offers: You may enjoy discounts and special offers on various categories, including dining, shopping, entertainment, and more. These offers can vary over time and are typically provided by partnering merchants.

- Balance Transfer and Installment Plans: The card may allow you to transfer balances from other credit cards and benefit from competitive interest rates. Additionally, it may offer flexible installment plans for larger purchases, allowing you to pay in easy monthly installments.

It’s important to note that specific features, benefits, and terms may vary based on the current offerings and terms provided by ADIB and Etihad Airways. It’s recommended to visit the official ADIB website or contact their customer service to get the most up-to-date and accurate information about the ADIB Etihad Guest Visa Gold Card.